It’s not often the U.S. government offers you a gift, but that’s exactly what they’ll do if you install a solar energy system on your property. The gift is a 30% tax credit that essentially pays you back almost one-third of the price to go solar.

The Solar Tax Credit was established some years ago to encourage homeowners and businesses to install solar energy systems. It greatly reduces the upfront cost of going solar, and is a major reason why so many homeowners in California and around the country have installed solar. (The other major reason people go solar: The remaining 70% of your system price is paid back to you through electric bill savings. And once the system has paid for itself, you get years of free, clean electricity.) But be aware that the 30% Solar Tax Credit starts to drop in just over a year, so you’ll get a bigger rebate if you go solar in 2019 than if you wait.

In this post, we cover how to get your own piece of the solar pie from Uncle Sam whether you installed solar in 2018 or are considering installing solar in 2019. And we give some basic tax information to help you understand how the Solar Tax Credit works, and if you’re eligible. (Almost everyone is.)

If, however, the very word “taxes” makes your eyes glaze over, call us instead and we’ll explain how it works and estimate the amount of your tax credit. You can also click to watch our short video about the Solar Tax Credit.

The Solar Tax Credit — Better Than A Deduction

If you’ve never experienced the joy of taking a tax credit before, you should know it is better than a tax deduction. A tax deduction is an amount you can take off your taxable income, so less of your income is subject to income taxes. But a tax credit comes right off the amount of taxes you owe for the year. So in almost all cases, it is worth much more to you than a tax deduction. If you want more information, the Internal Revenue Service (IRS) explains in detail the difference between a credit and a deduction here.

Not Sure What You Pay in Taxes?

Don’t worry, you are not alone! No one likes to dwell on what we pay every year to help run the U.S. government. Let us break it down and explain the parts that matter when it comes to solar.

Paycheck Tax Withholdings: First of all, know that if you earn a paycheck, you most likely are paying some federal (and sometimes state and city) taxes with every paycheck. Taxes are withheld in every pay period so you aren’t faced with one huge tax bill at the end of the year. To see what you are paying in taxes in each paycheck, have a look at a recent paycheck stub. There are many styles of paycheck stubs, but somewhere on yours you should see “Federal Income Tax” and a dollar amount. That tells you how much of your pay for that week (or two weeks or month, depending on how often you are paid) was sent to the IRS for taxes. Your stub probably also shows how much you’ve paid in Federal Income Tax for the year to date.

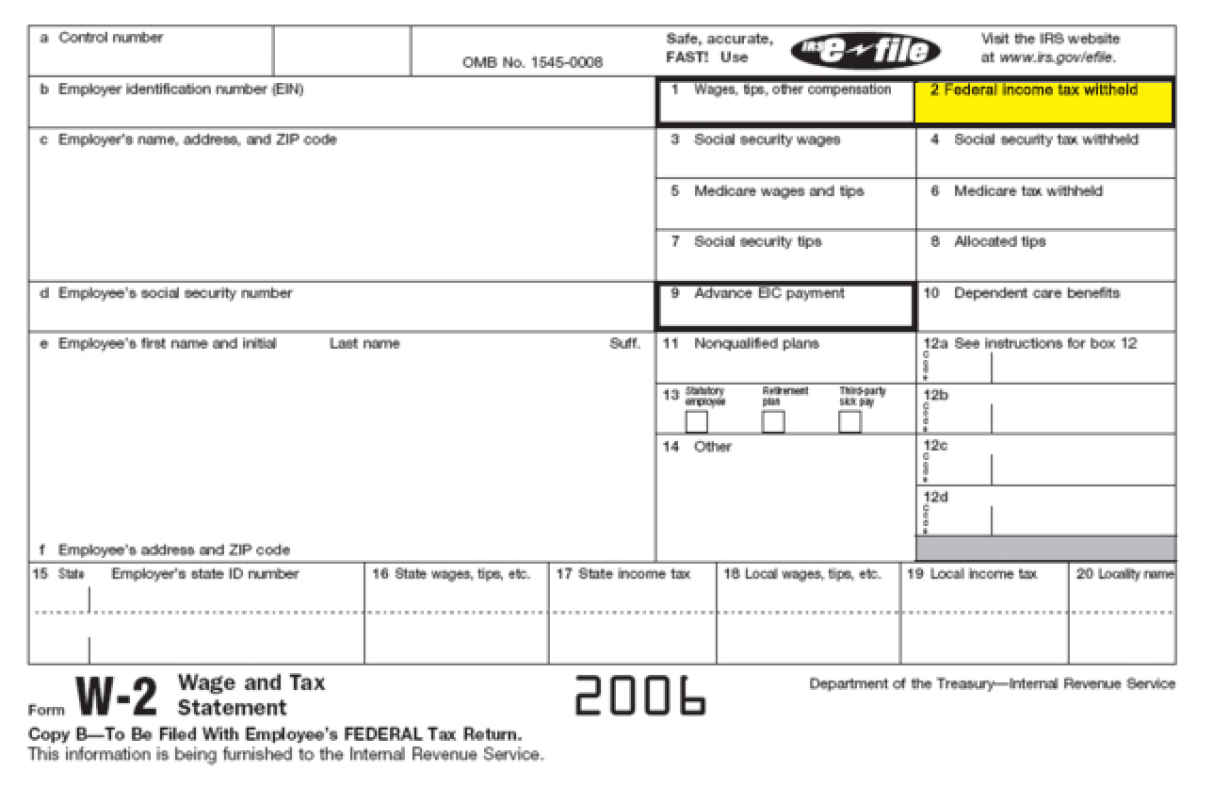

To see the total amount withheld from your paychecks in an entire year, look at the W-2 form your employer sent you for that year. Box 2 will say how much was withheld in federal taxes for the entire year.

To see the total amount withheld from your paychecks in an entire year, look at the W-2 form your employer sent you for that year. Box 2 will say how much was withheld in federal taxes for the entire year.

Actual Taxes Due: What you paid through paycheck withholdings, and what you owe for the year (which is called your “tax liability”), are rarely if ever the same. So now that you know what you did pay for the year, you need to find out what you should have paid for the year. That’s where your federal tax return filing comes in.

The federal tax return helps you calculate what you owe in taxes for the year, and compare that to what you actually paid. You already found the amount you paid on your W-2. The amount you should have paid for the year is shown as the “Total Tax” on your completed federal tax return. The Total Tax figure is in a different place on different versions of the tax form. If you use one of the following forms, here’s where you can find your Total Tax:

-

If you use Form 1040EZ, your Total Tax is on line 12.

-

If you use Form 1040A, your Total Tax is on line 39.

-

If you use Form 1040, your Total Tax is on line 63.

If your tax return determines that you paid too much in taxes, you get a refund from the IRS after filing your tax return. If you didn’t pay enough, you have the honor of writing a check to the IRS for the difference.

Who Is Eligible

Now that we’re clear on your tax obligations, let’s get back to the fun stuff: The 30% Solar Tax Credit. Am I eligible? you might be wondering. Yes, you are, if (1) you are a U.S. citizen who pays federal income taxes, (2) you install a solar energy system on your home, and (3) you file a federal tax return for the year in which your solar was turned on. One important note that affects a small percentage of people who install solar, usually seniors on fixed incomes who don’t pay a lot in federal taxes: Your Total Tax — as explained above, that is the total taxes you owe for the year — must be more than the amount of the tax credit in order to get the full 30%.

However — and this is good news — you can spread the Solar Tax Credit over several years if needed. So, for example, if you are only able to claim half of it on your tax return for the year in which you turned on your solar, you can “carry over” the rest and claim the other half on your tax return the following year. You can even spread it over three years. So whatever your income and tax liability, it’s very likely you will benefit from some or all of the Solar Tax Credit.

Timing

You are eligible for the Solar Tax Credit in the same year that you install and turn on your system. So if you installed solar in 2018, you claim the Solar Tax Credit when you file your 2018 tax return, which is due on April 15, 2019. If you install solar in 2019, you will claim the Solar Tax Credit on your 2019 tax return, which is due by April 15, 2020. As stated in the previous section, you can spread your Tax Credit over several tax returns if needed. But be sure to claim at least part of it in the year in which it was turned on.

Note that the last year to get the full 30% credit is 2019. After that, it ramps down. The U.S. government will pay the following percentage of your residential solar energy system’s price in future years:

-

26% for systems turned on in 2020

-

22% for systems turned on in 2021

-

0% for systems turned on after that.

Claiming Your 2018 Solar Tax Credit

If your solar was installed and turned on in 2018, you should claim your 30% Solar Tax Credit on your 2018 tax return. Use IRS Form 5695, which is called the ‘Residential Energy Credit” form, and claim the full price of your solar project, including equipment and installation labor. As of this writing, the 2018 materials have not been published by the IRS, but for reference, here are links to the 2017 IRS Form 5695, and the 2017 IRS instructions for completing the form. Be sure to use the 2018 materials when filing your taxes; you can get those when they’re available by going to this page of the IRS website and entering “5695” in the dark blue search box.

If you complete Form 5695 and include it with your 2018 tax return, and remember to submit your tax return by the April 15, 2019 deadline, you should be all set! The tax credit will be added to your refund check if the IRS owes you a refund. If you owe the IRS, the tax credit is deducted from what you owe.

How to Get the Solar Tax Credit in 2019

It’s simple — go solar! Contact Citadel Roofing & Solar today for a free proposal detailing how solar can save you money on your monthly electricity bill, and earn you a 30% tax credit worth thousands of dollars, possibly even more than $10,000. Your proposal will include an estimate of your Solar Tax Credit amount. So if you want to get off the treadmill of ever-increasing utility bills and get your piece of Uncle Sam’s solar pie, give us a call at (800) 400-2852 to speak with one of our Solar Consultants. Or fill out our web form and we’ll get back to you soon.

Our no-pressure approach is one reason we have such high customer satisfaction. Our 30 years of working on roofs (installing new roofs and solar energy systems) make us one of the more experienced solar installers in the state. And we keep it personal. We’re a local company, with offices in Vacaville, Roseville, and Valencia using only our own local employees, and after you sign up, we’ll give you one point of contact for the entire installation process.

Go solar. Go local. Save money. And get your big, fat check from Uncle Sam before it’s too late!

Citadel Roofing & Solar is not licensed to give tax advice. We encourage you to consult your CPA to learn how the Solar Tax Credit will impact you.