The U.S. government’s extension for filing federal income tax returns has brought a sigh of relief to American citizens and business owners feeling the coronavirus pandemic’s negative economic impacts. The deadline to file your income tax return and to pay your 2019 federal income taxes is now July 15, 2020, three months later than the original and typical April 15 date.

Why is a solar contractor telling you this? Because we want to remind those of you who installed solar energy systems in 2019 to claim your federal Investment Tax Credit (ITC) when you do file your federal tax return. With everything going on in our COVID-19-dominated world right now, it would be easy to forget you are entitled to that generous payment.

The ITC essentially pays you back 30 percent of the cost of your solar energy system, if the system was turned on in 2019. (For 2020, that figure drops to 26 percent.) It’s an extremely valuable benefit, for both individuals and Americans collectively.

To understand just how valuable, consider this: Citadel Roofing & Solar has installed thousands of solar energy systems for residential customers throughout California over the years. For a small system costing $12,000, the 30% ITC comes out to $3,600 for the homeowner. For a larger system costing $30,000, the tax credit would be $9,000.

Even if we use the lower figure of a $3,600 ITC for each of our thousands of residential customers, that translates into tens of millions of dollars received by Citadel’s customers alone!

Multiply that times all the residential solar energy system installations in the country, and then add the exponentially greater ITCs awarded for commercial solar energy systems, and the total amount is unfathomable. It’s also unidentifiable—we tried but couldn’t find a figure for how much money has been given to solar owners through the ITC since the first iteration came into being in 2005.

Back to tax season, you should know that the ITC is a tax credit, which is worth more than a tax deduction. Deductions are things like charitable giving and mortgage interest payments, which can lower the amount of your taxable income, and therefore lower the total taxes you owe. But a tax credit comes right off what you owe in taxes, dollar for dollar, and so is worth more than a deduction.

Say you owe the IRS $5,000 for 2019 but you’re entitled to a $4,000 ITC; you’ll write a check for $1,000. Say you don’t have to pay anything extra to the IRS when you file your tax return; in fact, you’re entitled to a $700 refund. In that case, you’ll get a $4,700 refund (assuming you paid that much or more in taxes through your paychecks). If you aren’t able to take full advantage of your ITC this year because it is more than what you owe the IRS, don’t worry—any unused portion will carry over to next year.

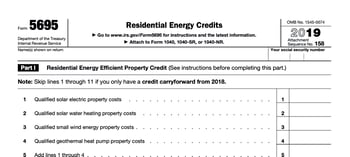

We all know how important every dollar is in this crazy time, so please don’t forget about your ITC if you are entitled to one. Whether you file on July 15 or sooner, you’ll want to use IRS Form 5695 for Residential Energy Credits to claim your ITC. You can find the 2019 Form 5695 here.

so please don’t forget about your ITC if you are entitled to one. Whether you file on July 15 or sooner, you’ll want to use IRS Form 5695 for Residential Energy Credits to claim your ITC. You can find the 2019 Form 5695 here.

Stay safe.