Solar incentives are changing, and homeowners need to know what's ahead. The federal solar Investment Tax Credit (ITC), which has made solar affordable for millions of American families, will no longer be available for homeowners after December 31, 2025.

The 30% federal tax credit has been a big help for millions of homeowners, but it’s not the only reason solar makes sense, especially in California. Even without the credit, solar can still lower your monthly utility bills, help you avoid rate hikes, and give you more control over your energy use as the grid faces more strain.

We'll break down what the ITC is, how to qualify, what’s changing, and what it means for your solar investment.

What Is the Solar Tax Credit and What Does It Cover?

The ITC allows you to claim 30% of your total solar installation cost as a credit on your federal income taxes. That applies to more than just solar panels:

Included:

- Solar panels

- Backup battery systems

- Installation and labor

- Required electrical or roofing upgrades

Not included:

- General maintenance

- Aesthetic upgrades

This credit applies whether it’s your primary home or a secondary residence, as long as you own the system. If you lease your system or sign a Power Purchase Agreement (PPA), the credit goes to the provider, not to you.

When the Credit Ends (and What That Means)

For years, the federal solar tax credit was scheduled to wind down gradually. That changed with the Big Beautiful Bill. The new policy eliminated the step-down schedule and replaced it with a firm cutoff. Now, the 30% credit is set to end entirely for residential customers after December 31, 2025.

To qualify, your solar system needs to be fully installed and paid in full by the end of that year. It doesn’t need to be turned on or connected to your utility by then; it just needs to be in place and paid for.

The good news is there’s still time to plan ahead, explore your options, and make a confident decision.

Why Homeowners Are Paying Attention

- In 2023, more than 1.2 million people claimed $6.3 billion in residential clean energy credits.

- In early 2025, solar made up nearly 70% of all new U.S. electric capacity.

The ITC has been a driving force behind residential solar growth, helping millions of homeowners make the switch. Now that it’s set to expire, more people are looking into solar and exploring their options before the credit goes away.

Will Solar Still Make Sense After 2025?

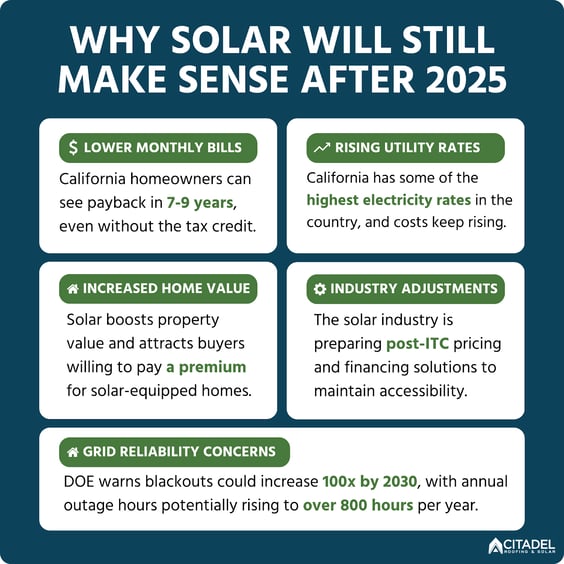

Absolutely. While losing the 30% tax credit will impact the financial equation, solar remains a smart investment for California homeowners. Here's why:

Lower Monthly Bills: Many California homeowners can see payback in 7 to 9 years, depending on system size and energy use, even without the tax credit.

Rising utility rates: California has some of the highest electricity rates in the country, and costs keep going up. Solar helps shield you from those increases.

Increased home value: Solar can boost your property’s value and make it more attractive to potential buyers. Many are willing to pay a premium for homes with solar already installed.

Industry adjustments: The solar industry is already preparing for post-ITC pricing and financing solutions that will help maintain accessibility.

Growing grid reliability concerns: A recent analysis from the Department of Energy warns that blackouts could increase by 100 times by 2030, with annual outage hours potentially rising from single digits to over 800 hours per year. A solar system with battery storage can keep your lights on and essentials running when the power goes out.

Making Your Decision

If you’ve been considering solar, this is a good time to explore your options and see if you can take advantage of the credit while it’s still available. While solar will remain worthwhile beyond 2025, the 30% federal tax credit offers significant savings that won't be available much longer.

Next steps:

- Get a consultation to understand your home's solar potential

- Review your current electricity usage and costs

- Explore financing options that work with your timeline

- Plan for installation well ahead of the year-end deadline

Frequently Asked Questions

- Q: What is the solar tax credit?

- A: The federal solar tax credit allows you to deduct 30% of your solar system cost from your federal taxes. For many homeowners, this can save around $8,000-$15,000, depending on system size.

- Q: When does the solar tax credit end?

- A: The residential solar tax credit expires completely on December 31, 2025. There will be no federal tax credit for home solar systems starting in 2026.

- Q: What costs are covered by the tax credit?

- A: The credit covers the cost of your solar system, including panels, inverters, batteries (if included), installation labor, permits, and inspection fees.

- Q: What do I need to do to get the 2025 tax credit?

- A: Your solar system must be fully installed and completely paid for by December 31, 2025.

- Q: What happens if I miss the 2025 deadline?

- A: If your system isn't installed and paid for by December 31, 2025, you won't qualify for any federal tax credit. However, solar is still a smart investment that can save you money on electricity bills for decades and give you energy resilience.

- Q: Is solar still worth it without the tax credit?

- A: Yes. While payback periods will be longer, most homeowners will break even within 7-9 years and save money for decades after that.

Create Your Solar Plan

Solar is an investment in your home's future, whether you move forward this year or next. At Citadel Roofing & Solar, we've guided thousands of California homeowners through their solar decisions, and we’re to help you explore your options and answer any questions.

Contact our team today for a free consultation and see how solar can work for your family, whether you're planning for 2025 or beyond.